Gold finished 2022 virtually flat after a tumultuous year, seeing its price surge to all-time highs around the start of the Russian invasion in Ukraine, yet as the Fed rushed to tame rogue inflation by aggressively hiking rates, its prices quickly pared most of its gains. The precious kickstarted this year strong, as worldwide recession worries and speculations for a pivot in the Fed’s monetary policy stance helped put a floor under gold’s prices and helped the shiny metal’s advance to its eight-month highs, in today’s trading session. In this report we aim to shed light on the catalysts driving the precious metal’s price, assess its future outlook and conclude with a technical analysis.

Divergent interpretations of the US employment data

Last week, the initial jobless claims figure dropped more than expected as only 204k filed for unemployment benefits in the past week. Furthermore, the ADP employment report recorded an upside surprise, as the US economy added 235k new jobs in the month of December higher than the 150k expectation and job creation nearly doubled compared to the previous figure of 127k of the previous month. The results once again validated the view that the US labour market remains resilient and healthy, despite growing fears for an impending recession. The favorable results give more room and confidence to the Fed to continue on with its restrictive monetary policy efforts at taming inflation, obstructing it from becoming deeply entrenched within the US economy. As a result, the greenback found renewed support and rose from its recent slump, while on the contrary the precious saw its 4-day winning streak snap, due to their inherent negative correlation. On Friday however, the highly anticipated NFP report, despite showcasing that the US labour market retained its ability to create jobs amidst a challenging environment, it evoked a strange reaction from the market. The non-farm payrolls figure reported an increase of 223k, higher than the expectation of a mere 200k, yet came less than the previous month figure. The unemployment rate eased to 3.5%, beating, both expectations and the last month’s reported rate, while the month-on-month average hourly earnings eased more than expected at 0.3% when compared to the previous month of 0.6%. The dollar was sharply down và gold alongside US equities, managed to close the day notably higher, in the greens, as market participants assessed the results and ended up siding with the rationale that the Fed would inadvertently be forced to pivot by the end of the year. Possibly another data point adding to the fueled bets for slower Fed hikes was the deterioration in the Services sector of the US economy which unexpectedly contracted at its steepest pace in more than two and half years amid weakening demand, according to the December ISM Services PMI figure.

Gold Market pushback against Fed narrative

There has been without a doubt, an observed deviation in the perception of where the target rate will peak in 2023, between the Fed và the market in recent months. In its December meeting minutes the Fed explicitly stated its unanimous resolve to continue on with more rate hikes in going forth and pause throughout the remainder of the year, despite the rising risks for tipping the economy into a recession. Whereas on the flip side the market actively prices in that the Fed will flinch and will start cutting rates as its overtightening efforts could cripple the growth trajectory of the US economy. Tomorrow Tuesday, the market will be paying close attention the scheduled speech by Fed Chair Powell and on Thursday market participants will brace for the latest round of crucial CPI data. According to estimates the year-on-year inflation rate for December is expected to decelerate to 6.5% from the 7.1% of the previous month and should the actual rate meet the expectations we may see the USD retreat to lower ground and boost appetite for the shiny metal.

Phân tích kỹ thuật

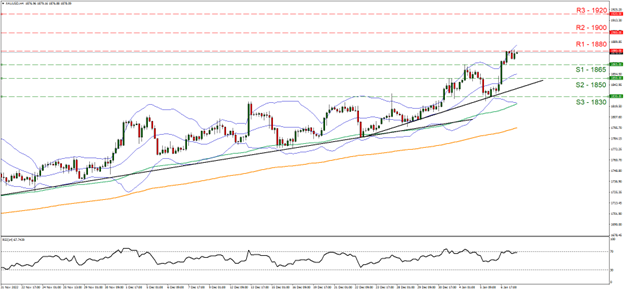

XAUUSD H4 Chart

- Support: 1833 (S1), 1818 (S2), 1800 (S3)

- Resistance: 1850 (R1), 1865 (R2), 1880 (R3)

Looking at XAUUSD 4-hour e observe gold’s incredible run-up to the $1880 level where it is currently found trading after a few volatile sessions. We hold a bullish outlook bias given the ascending trendline highlighting the commodity’s upward trajectory alongside the RSI indicator below our 4-hour chart which registers a value of 70, showcasing the extreme bullish sentiment surrounding the bullion. Moreover, the fact that the price action trades closely to the upper bound of the Bollinger Band adds to our case for a bullish outlook. We should note however, that should an extreme move to the upside occur, breaking past the upper Bollinger band aggressively, we may expect a correction lower as the price action could get ahead of itself. Should the bulls reign over, we may see the definitive break above the $1880 (R1) level and the price action rising and possibly challenging the $1900 (R2) resistance barrier. Should on the other hand the bears take over, we may see the price action retracing its steps, break below the $1865 (S1) support level and head to lower ground closer to the $1850 (S2) support base.

Khước từ trách nhiệm: This material is for general informational & educational purposes only and should not be considered as investment advice or an investment recommendation. T4Trade is not responsible for any data provided by third parties referenced or hyperlinked, in this communication.